Losing my uncle last year was hard enough, but the technical nightmare that followed was something I never expected. He was one of those early Bitcoin believers—always talking about “the future of money” at Thanksgiving. But when he passed away, that future seemed locked behind a digital wall we couldn’t break.

No password, no “seed phrase,” no instructions. For months, our family assumed his Bitcoin and Ethereum were just… gone. Just another “burned” wallet in the sky.

But I couldn’t let it go. I spent six months digging through legal paperwork and technical forums. Today, I can finally say I recovered his assets. If you’re staring at a deceased loved one’s empty screen in 2026, here is my raw, honest guide on how I navigated this mess legally.

1. The Hard Truth I Had to Face

The first thing I learned? The blockchain is cold. It doesn’t care about a death certificate or a grieving family. If the crypto is in a “Cold Wallet” (like a USB stick) and you don’t have the 24 words, you are likely out of luck.

However, I caught a break. While cleaning out his desk, I found an old tax form that mentioned Coinbase. That changed everything. If the money is on an exchange, you aren’t fighting math; you’re just fighting corporate bureaucracy.

2. The Paperwork That Saved Me

I quickly realized that crypto exchanges are terrified of lawsuits and money laundering. They won’t even look at your email unless you have your “legal ducks in a row.“

Here is exactly what I had to gather (and where I found it):

My “Digital Recovery” Document Kit

| What I Needed | Why It Mattered | My Advice |

| Death Certificate | The absolute baseline. | Get at least 5 certified copies; you’ll need them. |

| Letters of Testamentary | Proves the court picked YOU to handle the estate. | This was the hardest part. Requires a probate lawyer. |

| Affidavit of Heirship | Confirms who gets the money. | Don’t DIY this; have an attorney sign off. |

| My Own ID | They need to know who they are dealing with. | Make sure your ID matches your legal name perfectly. |

3. My 45-Day Battle with Support

I didn’t just send a random email. I found that most big exchanges have a specific (but hidden) portal for “Deceased Account Holders.“

-

The Waiting Game: After I submitted my court documents, silence. It took 45 days. I had to follow up every week just to make sure my ticket hadn’t “expired.“

-

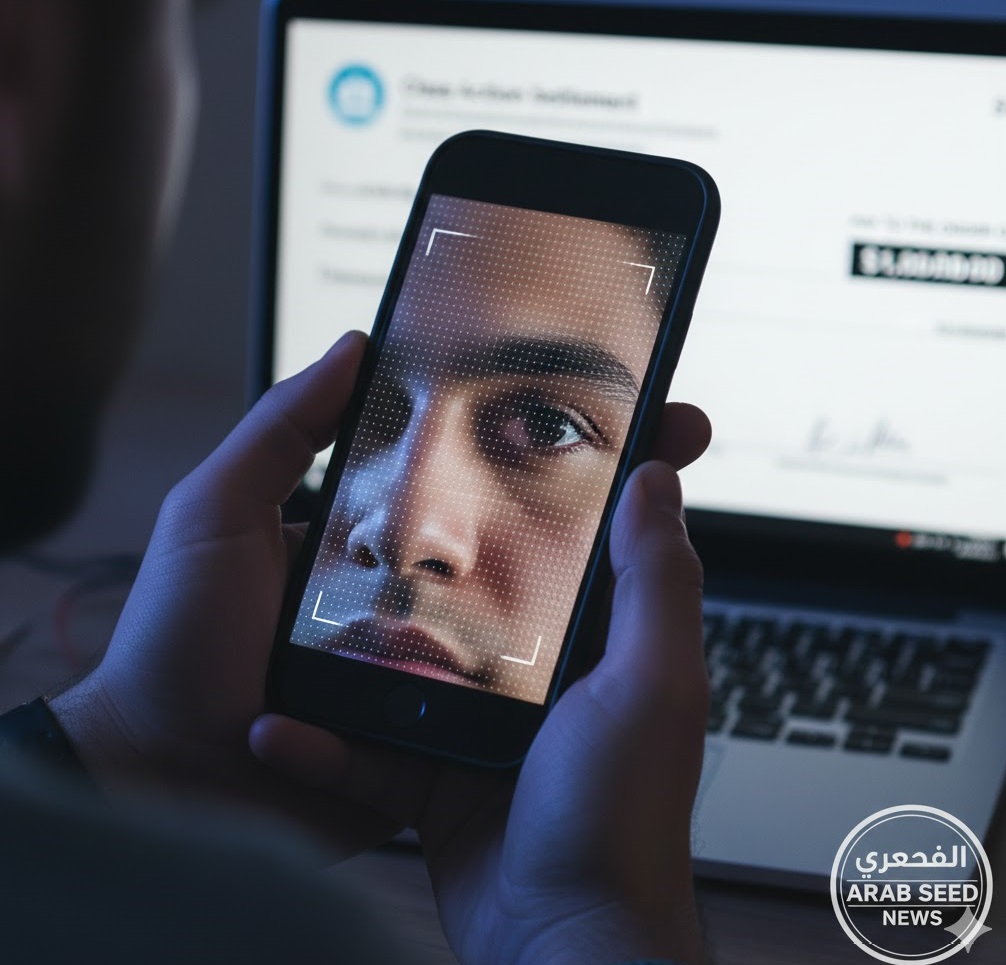

The “KYC” Trap: I actually had to open my own account on the same exchange and go through their identity verification (KYC). They wouldn’t just send me a check; they insisted on a “wallet-to-wallet” transfer.

-

Tax Tip: I specifically asked them not to sell the coins for USD. I wanted the assets moved “in-kind” to my account. This saved the estate from a massive, immediate tax bill.

4. The “Cold Wallet” Miracle

While the exchange was processing, I still had his Ledger hardware wallet. I was about to give up until I found a “Seed Phrase” written on the back of a boring old life insurance policy in his safe deposit box.

A warning from my heart: While I was searching for help online, three different “Recovery Experts” tried to scam me. They promised they could “hack” the wallet if I gave them $500. They are liars. If someone asks for money upfront to “recover” crypto, block them immediately.

5. What This Taught Me (The Hard Way)

This ordeal changed how I view my own digital life. I realized that if I died tomorrow, my spouse would be just as lost as I was.

I’ve now set up a “Dead Man’s Switch.” It’s a simple service that sends an encrypted email with my wallet locations and instructions to my family if I don’t check in for six months. It’s morbid, sure, but after what I went through, it’s the greatest gift I can leave them.